Money can be a game changer depending on how you handle it. Whether it grows or remains stagnant is all in your approach! For those who have been saving diligently but haven’t delved into the world of investing, this article is tailored for you! We’ll discuss the differences, between saving and investing while highlighting their importance and guide you in determining the right time and method to dive into investing to maximize your earnings potential.

Grasping the Fundamentals

Saving refers to the act of storing money for future use, by placing it in a secure location like a savings account where it can be easily accessed when needed. The primary purpose of saving is typically to establish an emergency fund or save up for a specific goal. The main focus here is, on ensuring availability and liquidity of the funds.

“Do Not Save What Is Left After Spending, But Spend What Is Left After Saving.” — Warren Buffett

Why Saving Alone Isn’t Enough

Simply saving money is not sufficient for financial growth, despite its importance in securing finances as most savings accounts typically yield minimal interest rates that are often lower, than the inflation rate itself — resulting in a potential loss of value over time. Investing plays a vital role in this scenario as it offers the opportunity to generate returns that exceed inflation rates and facilitate the growth of wealth over time.

What is Investing?

Investing refers to putting your money into assets such as stocks or real estate to see them grow over time. Unlike saving where the money is kept securely but without the growth potential that investing offers, investing comes with risks as the value of your investments can go up or down leading to a loss of money; nevertheless taking on these risks also opens up the possibility for higher rewards in return. It’s important to view investing as a long-term plan, for building wealth than expecting immediate gains.

“It’s not how much money you make, but how much money you keep, how hard it works for you and how many generations you keep it for.” (Robert Kiyosaki)

Investing Asset Classes: A Quick Overview

Cash and cash equivalents such as savings accounts and money market funds are considered as safer assets due to their liquidity and stability features. They offer low returns and are suitable for short-term needs or as part of an emergency fund.

Bonds When you purchase bonds you are loaning money to governments or businesses in return for regular interest payments. The initial investment is returned upon the maturity of the bond. Bonds are typically considered less volatile than stocks while providing lower returns in comparison.

Mutual funds are actively managed by a fund manager. They are a pool of multiple asset types such as stocks, bonds, and other types of assets, providing diversification, lower risk, and exposure to multiple asset classes for the investors.

ETF (Exchange Traded Fund); ETFs are very similar to mutual funds, but they can be traded in the stock market like stocks, providing flexibility to investors. Another important difference between ETFs and Mutual Funds is that ETFs provide lower fees, maximizing the returns of long-term investors.

Stocks When you buy stocks, it’s like you own a tiny piece of that company. Stocks are usually more volatile than bonds, but they offer a higher return potential. Apart from the potential capital gain, some stocks also provide dividends that are regular payments provided to investors for owning the stock.

Investing in the S&P 500: A Smart Long-Term Strategy

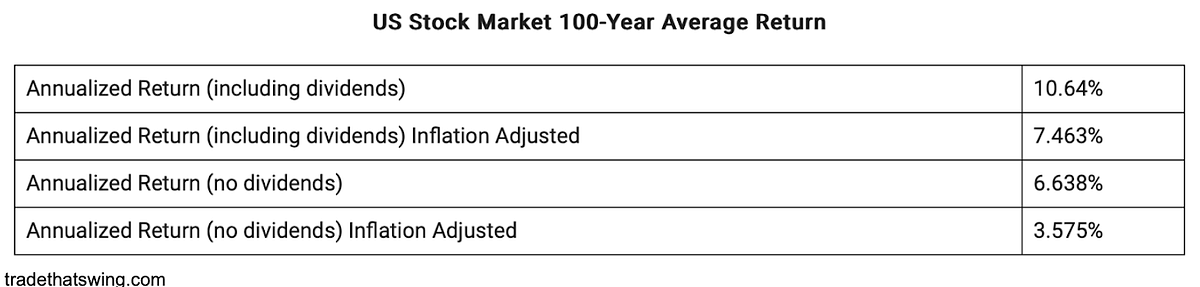

When you invest in the S&P 500, you’re essentially buying a piece of the Top 500 publicly traded companies in the United States. S&P 500 offers diversification across different industries and sectors and on average returns an annual 10% based on historical statistics.

Investing in S&P 500 for a long-term allows investors to mitigate some of the risks associated with buying individual stocks and at the same time to benefit from the growth of the US economy.

During the last 100 Years, and taking into account the volatility during bull markets, bear markets and periods of sideways, S&P 500 provided on average an annualized 10% return to long-term investors, setting it as a benchmark for the growth of US economy.

Prior to diving, into investments

Investing for the first time can feel daunting if you’re new to it all, but rest assured you don’t have to be rich or a finance guru to begin this journey! Here are some steps to take before embarking upon your investment adventure.

Emergency fund

It’s important to have an emergency fund set aside to cover your living expenses for at least 6 months. You can keep those funds in a Savings account and it will be used as a safety net to cover unexpected needs or an emergency.

Set a Goal

Make sure to have a goal in mind for the long term. Maybe saving up for something, like retirement or a house or for education purposes. Investing for a purpose could make your money grow more, compared to just saving it up on its own.

Budget

Building a budget is the foundation for saving and investing. You need to understand how much money you earn, how much money you spend, and how you spend them. Categorize your spending into Essentials (like Housing, Food, and Transportation) and non-Essentials (like Personal Spending and entertainment). Use an App or a Spreadsheet to track your expenses and make sure you follow your plan consistently.

Pay off consumer/credit card debt

It’s important to clear off any consumer or credit card debt before diving into investing activities as high-interest debts can eat into investment gains and hold back wealth accumulation efforts substantially. Getting rid of these debts foremostly before launching into investments can release funds for investing purposes while also easing financial burdens and setting a strong basis, for future financial prosperity.

Comparing Savings and Investments Across 10, 20 and 30 Year Periods

Let’s dive into a real-life scenario to explore how saving stacks up against investing, across time frames.

Scenario

- Starting Balance: $1,000

- Monthly contribution: $100

- Time periods: 10, 20, and 30 years

- Savings interest rate: 2% per year (a typical savings account)

- Investment return: 10% per year (average historical return of the S&P 500)

Option 1: Saving

Let’s see how much your savings would grow in a bank account with a 2% annual interest rate.

After 10 years:

- Total Contributions: $1,000 + $100/month for 10 years = $13,000

- Total Savings Value: Approximately $14,478

After 20 years:

- Total Contributions: $1,000 + $100/month for 20 years = $25,000

- Total Savings Value: Approximately $30,909

After 30 years:

- Total Contributions: $1,000 + $100/month for 30 years = $37,000

- Total Savings Value: Approximately $50,937

Option 2: Investing

Now, let’s compare that with investing in a portfolio that tracks the S&P 500, which has historically returned about 10% per year on average.

After 10 years:

- Total Contributions: $1,000 + $100/month for 10 years = $13,000

- Total Investment Value: Approximately $22,580

After 20 years:

- Total Contributions: $1,000 + $100/month for 20 years = $25,000

- Total Investment Value: Approximately $78,553

After 30 years:

- Total Contributions: $1,000 + $100/month for 30 years = $37,000

- Total Investment Value: Approximately $223,733

The Difference in Growth

The outcome here clearly shows the impact of putting money into investments compared to just saving.

After 10 years, investing could leave you with an extra $8,102 compared to saving.

After 20 years, that difference grows to over $47,644.

After 30 years, the gap becomes even more staggering, with investing potentially providing $172,796 more than saving.

This example demonstrates the huge difference Investing can make compared to Saving over the long-term. Time is the key factor to grow your wealth so it’s essential to start your Investing journey the soonest possible. Compound interest could make miracles if you keep your investing journey for long-term. Patience is very important for long-term investors.

“The stock market is designed to transfer money from the Active to the Patient.” — Warren Buffett

Exploring the Emotional Aspects of Investments

When it comes to investing it’s not all about the figures — emotions play a significant role too! Market fluctuations can stir up anxiety in us naturally when things take a dip; the trick is to stay composed and stick to your strategy.

Remember…

Investing is a marathon, not a sprint.

Conclusion

Balancing saving and investing is key. Saving acts as a safety cushion while investing fuels wealth growth, fostering a secure present and prosperous future financially.

If you haven’t started your investing journey yet, the best time to start is NOW. You can either open a brokerage account to start buying assets like Stocks, Bonds or ETFs or you can even start by exploring your options and learning the basics that would help you adapt to the mindset of a long-term investor. Put your money to work for you and watch them grow over time.

Disclaimer: The information presented in this article reflects my personal views and opinions and is for informational purposes only. You should consider doing your own research first before you start any kind of investment or even seek professional advice.